How To Avoid The Gift Tax In Real Estate

4.8 (65) · € 24.50 · In Magazzino

Real estate gift tax applies any time an individual transfers property to someone without receiving full market value in return. Learn how you can avoid it.

Gift Tax: 3 Easy Ways to Avoid Paying the Gift Tax

![How to Avoid the Idaho Gift Tax [Step by Step] »](https://estatecpa.com/wp-content/uploads/2021/07/IMG_2079.jpg)

How to Avoid the Idaho Gift Tax [Step by Step] »

Real Estate Gift Tax - What It Is and How to Avoid It - RealtyHop Blog

How to Avoid Paying Gift Tax: 13 Steps (with Pictures) - wikiHow Life

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png)

Estate Tax Exemption: How Much It Is and How to Calculate It

How to Avoid Gift Tax

Let's Talk About Gifts

How To Avoid The Gift Tax In Real Estate

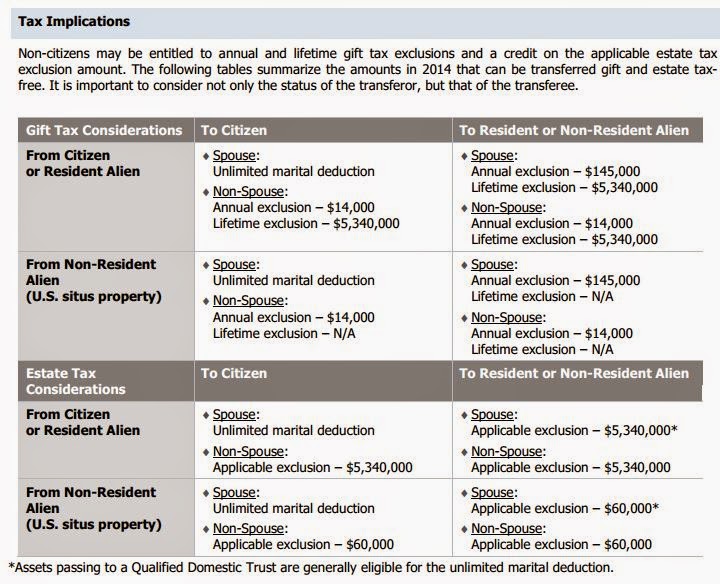

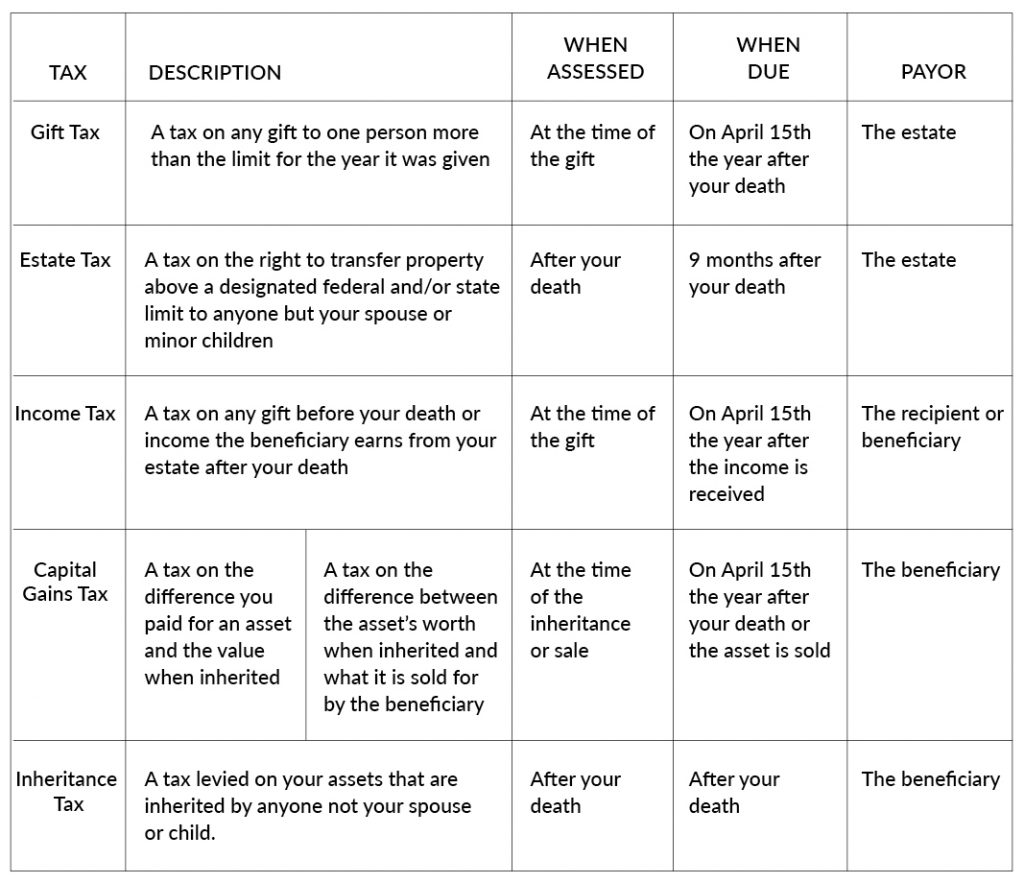

Estates and Taxes - Plan for Passing On

ES402: Introduction to Estate & Gift Tax

How to give to family and friends — and avoid gift taxes - WTOP News

Are Closing Gifts For Real Estate Tax Deductible? - Pumeli

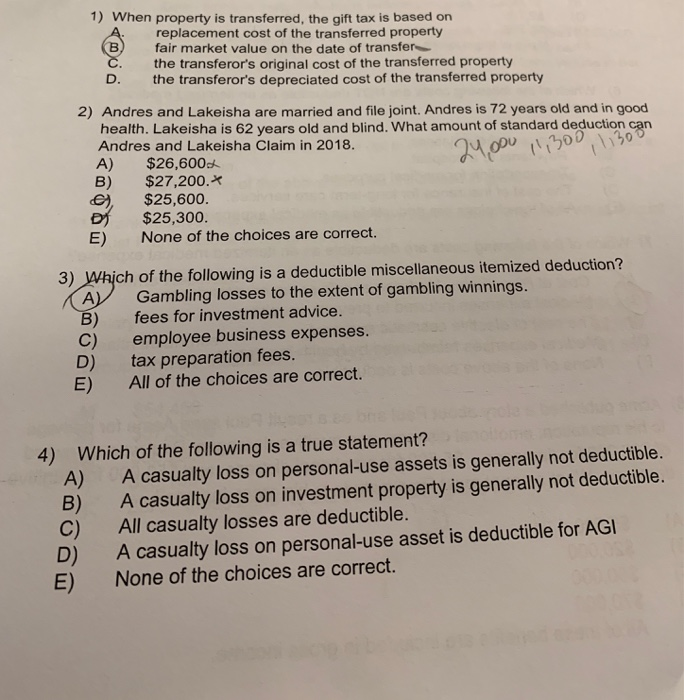

Solved 1) When property is transferred, the gift tax is

Gift tax: Generosity and Total Tax: What You Need to Know About Gift Tax - FasterCapital

Gift Tax Limit 2024: How Much Money Can You Gift?